vanguard long term tax exempt fund

VCITX California Municipal Money Market Fund. VTEAX - Vanguard Tax-Exempt Bond Index Admiral - Review the VTEAX stock price growth performance sustainability and more to help you make the best investments.

How Much Can Tax Managed Model Portfolios Save On Taxes Morningstar

This file lists all Vanguard funds and share classes with 2022 distributions and capital gains.

. Americas leading expert on investing in Vanguard funds Daniel P. July 2 2018 at 1201 pm. These funds have staying power into 2023 and beyond.

How to Recognize Capital Loss forum discussion direct link to post. Term Tax Exempt Fund forum discussion. But even if you meet these criteria you might not receive a 1099-DIVespecially if your income totaled less than 10 for a particular investment.

Vanguard Tax-Exempt Bond Index Fund Admiral Shares Fidelity. To request a Prospectus for a Non Vanguard Mutual Fund or ETF by mail please contact us at 1-800-VANGUARD. 7 Best Long-Term ETFs to Buy and Hold.

For additional financial information on Vanguard Marketing Corporation see its Statement of Financial Condition. Vanguard ETF Shares are not redeemable with the issuing Fund other than in very large aggregations worth millions. Private equity is capital that is not noted on a public exchange.

SPDR SP Midcap 400 ETF Trust. I currently have my cash parked in Vanguard short term inflation protected security fund VTAPX. Vanguard funds not held in a brokerage account are held by The Vanguard Group Inc and are not protected by SIPC.

You could lose money by investing in the Fund. IShares Core Total USD Bond Market ETF. Accessed January 27 2017.

Although the Fund seeks to preserve the value of your investment at 100 per share it. For additional financial information on Vanguard Marketing Corporation see its Statement of Financial Condition. Click Additional criteria to select more fields.

Thanks for the clarification Harry. Private equity is composed of funds and investors that directly invest in private companies or that engage in buyouts of public. A high correlation between funds may mean that your portfolio of funds is not as diverse as you might want it to be.

As of January 2022 the fund has an average 3-year pre-tax annualized return of 933 763 for the last five years and 729 over 10 yearsresults that have consistently earned it a four- or. Tax-exempt Specialty Vanguard money market funds Balanced funds Taxable Domestic Tax-exempt International Fund category select up to five. California Long-Term Tax-Exempt Fund Investor Shares.

This fund is essentially a combination of municipal-bond fund Vanguard Intermediate-Term Tax-Exempt VWIUX and equity fund Vanguard Tax-Managed Capital Appreciation VTCLX both of which carry. Yield on Vanguard Int. Vanguard Cash Reserves Federal Money Market Vanguard Federal Money Market Fund and Vanguard Treasury Money Market Fund.

Tax-exempt interest dividends from these funds as reported on Form 1099-DIV Box 11 are taxed differently at the federal state and local levels and. From a tax-exempt bond fund or money market fund you received interest dividends including specified private activity bond interest. Justin Schwartz has run this fund.

While other tools may compare funds only to the SP 500 or 500 Index fund you can use this tool to determine how closely the performance of one Vanguard stock fund tracks that of any other Vanguard stock fund. Vanguard funds not held in a brokerage account are held by The Vanguard Group Inc and are not protected by SIPC. Vanguard Intermediate-Term Tax-Exempt Bond is managed by diligent leaders through a sensible and risk-conscious investment process and benefits from ultra-low fees.

VCTXX. Find out why you might not receive Form 1099-DIV. Publication 550 2015 Investment Income and Expenses direct link to section Worthless securities.

California Long-Term Tax-Exempt Fund 100. Wiener is editor of The Independent Adviser for Vanguard Investors a monthly newsletter that keeps abreast of recent developments at Vanguard and the annual FFSA Independent Guide to the Vanguard FundsThrough his newsletter and guide book Dan helps tens of thousands of. It provides breakdowns of NRA-exempt income and short-term gains and lists funds eligible for short- and long-term gains under the Foreign Investment in Real Property Tax Act FIRPTA.

7 Questions to Ask When Buying a Mutual Fund. And you should not expect that the sponsor will provide financial support to the Fund at any time. Although the income from a municipal bond fund is exempt from federal tax you may owe taxes on any capital gains realized through the funds trading or through your own redemption of shares.

Vanguard Short-Term Inflation-Protected Securities ETF. Vanguard Tax-Exempt Bond ETF. For some investors a portion of the funds income may be subject to state and local taxes as well as to the federal Alternative Minimum Tax.

The interest is still exempt from state income tax wherever you buy. The data that can be found in each tab includes historical performance the different fees in each fund the initial investment required asset allocation manager information and much more. Investors in higher tax brackets might receive higher after.

Both share classes earn a. Brokerage assets are held by Vanguard Brokerage Services a division of Vanguard Marketing Corporation member FINRA and SIPC. Vanguard Tax-Exempt Bond Index Fund A list of the best bond index funds would be incomplete without a nod to the tax-exempt offerings.

Total funds found must be 250 or less to get results. Vanguard Short-Term Tax-Exempt Bond is managed by diligent leaders through a sensible and risk-conscious investment process and benefits from ultra-low fees. Funds and Vanguard Tax-Managed Balanced Fund on your year-end tax returns.

Vantage ISA or Vantage SIPP are exempt from tax. For the amount I buy I always buy at the auction. View the latest Vanguard LifeStrategy 80 Equity Accumulation Fund price and comprehensive overview including objectives charges and savings.

Interest earned on a short-term TIPS fund. Vanguard Short-Term Bond To find out detailed information on Vanguard Short-Term Bond in the US click the tabs in the table below. Brokerage assets are held by Vanguard Brokerage Services a division of Vanguard Marketing Corporation member FINRA and SIPC.

Vanguard Abandons Factor Etfs In U K Adviser Investments

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Vwltx Vanguard Long Term Tax Exempt Fund Investor Shares Ownership In Us64966qcu22 Fx Rt Muni Bond 13f 13d 13g Filings Fintel Io

3 Best Vanguard Mutual Funds To Grab In August

7 Best Vanguard Bond Funds To Buy In 2022

Best Vanguard Funds For Every Stage Of Your Life Fatfire Woman

Which Bond Fund Etf Should I Invest In Vanguard Long Term Bond Funds Etfs With High Yields Youtube

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Emergency Fund In Vnytx Or I Bonds Vanguard Ny Long Term Tax Exempt Bogleheads Org

Vnytx Vanguard New York Long Term Tax Exempt Fund Investor Shares Vanguard Advisors

The 7 Best Bond Funds For Retirement Savers In 2022 Nasdaq

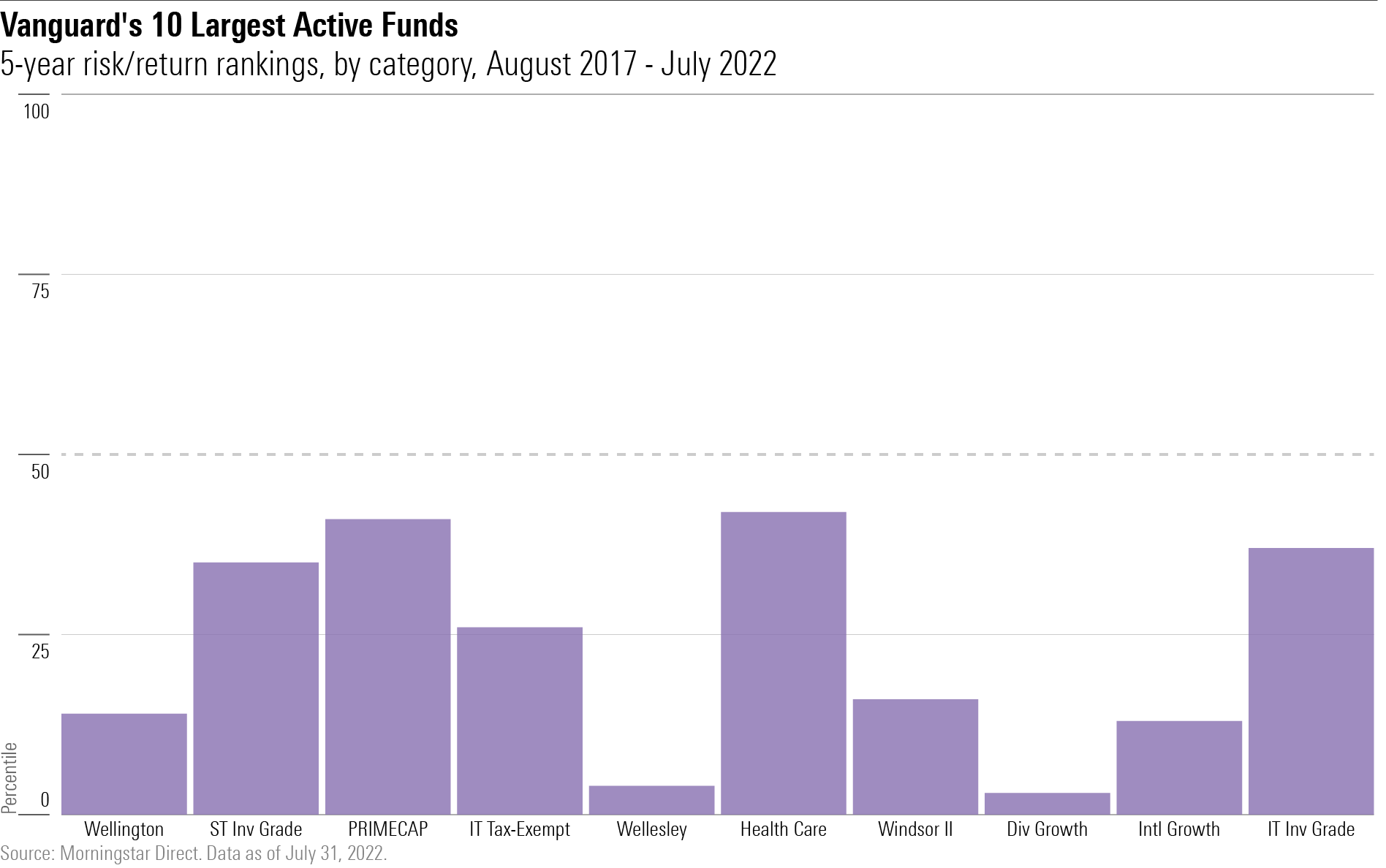

Investors Are Shunning Vanguard S Best Funds Morningstar

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Tax Exempt Interest Dividends By State For Vanguard Municipal Bond

Vclax Vanguard California Long Term Tax Exempt Fund Admiral Shares Class Info Zacks Com

Emergency Fund In Vnytx Or I Bonds Vanguard Ny Long Term Tax Exempt Bogleheads Org

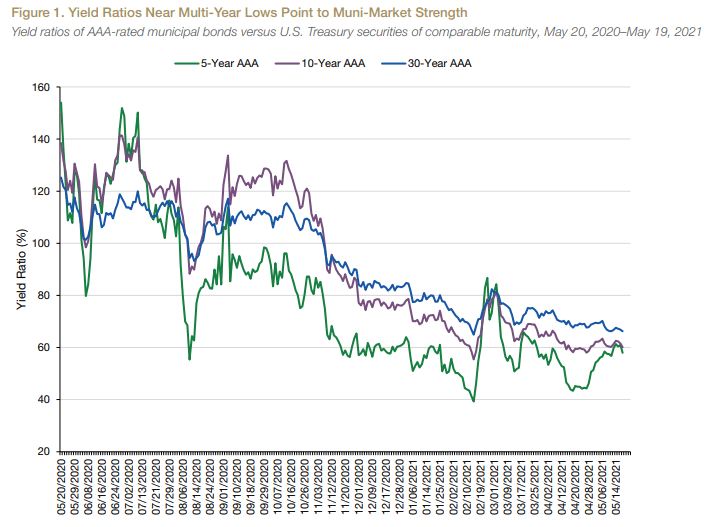

What The Inflows For Vanguard S Bond Etfs Indicate

Vanguard Plans Benchmark Changes For Three Bond Funds And Etfs